FX Trading Portal

By Alexander Barzykin, FX eRisk, Markets & Securities Services, and Farzana Nanji, EMEA Head of eFX Sales, Markets Securities Services, at HSBC.

Over the course of the last decade, the evolution of spot has moved from traditional voice trading to electronic execution via a Request for Quote (“RFQ”), streaming, and more recently algorithms. The expansion of electronic markets, liquidity and infrastructure has given clients the opportunity to be in the driving seat of their own execution. This is in part due to the development of execution tools and analytics to help them navigate the uniquely fragmented FX market.

The first iteration of execution algorithm was based around a Time Weighted Average Price (“TWAP”), which split the parent order into multiple smaller child orders, executed in a periodic fashion with limited functionality and adaptively. The goal of algorithmic execution is primarily to minimise the market footprint, while simultaneously maximising the spread capture. Straightforward deterministic order placement can hardly achieve that nowadays due to trading pattern detectability. The new generations of algorithms have been designed to deal with these complexities adaptively, leveraging modern machine learning capabilities to use the increasingly sophisticated and geographically delocalized liquidity landscape of electronic FX markets to client advantage.

Depending on the trading objectives, there is a selection of algorithms designed for each risk/ reward profile. Passive versus aggressive execution is a question of risk versus reward. Passive execution aims to explore cost saving opportunities while facing higher risk of deviating from the target benchmark. Aggressive execution style aims to minimise this risk while somewhat sacrificing transaction cost savings. Performance of the execution algorithms can be judged against a number of industry standard benchmarks. The most commonly used benchmarks include a risk transfer price (volume adjusted electronic price at inception), arrival price (market mid-price at the start of execution) and time/volume weighted average market price. These benchmarks can be calculated and verified independently, thus providing the clients the opportunity to objectively compare the execution algorithms of different providers. When clients have made an informed decision on their execution strategy and their subsequent parameters, the algorithm will interact with the market and ultimately will face the same risk-reward question to define the optimal child order allocation at each moment of time using two order types:

• Passive Order: The reward is the spread capture, and the risk is driven by market volatility due to fill uncertainty.

• Aggressive Order: The market volatility risk exposure is minimised given the instantaneous execution, however this comes at a cost of crossing the spread. Aggressive orders also carry a degree of fill uncertainty, which often gets overlooked.

The role of last look, fragmentation and geographical delocalisation aspect of FX introduces latency factors as an inherent and significant source of fill uncertainty.

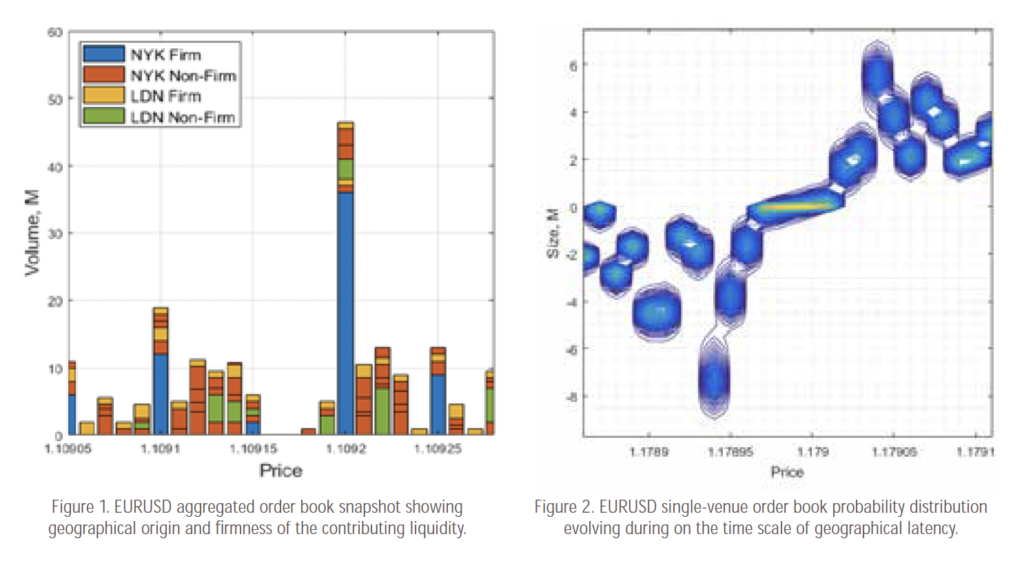

• Fragmentation & Geographical delocalisation: Multiple order book events can take place while the information travels from one liquidity centre to the other. The liquidity consumer sees the order book snapshot which is already old and may have changed and will change even more during the time until the order reaches the liquidity pool for execution. This makes the definition of true market price obscure.

• Last Look: specific to FX, last look aims at protecting the liquidity provider from adverse selection. On the other hand, it can create an illusion of liquidity and deteriorate the quality of algorithms execution due to potential information leakage and geographical arbitrage.

Geographical latency can become increasingly exacerbated when trading over a time zone transition while moving from one liquidity centre to the other. Additional latency components arise due to throttling of certain data feeds. Liquidity venues communicate different data types regarding market orders, which sometimes have additional implications in the methodology used to consume it. Overall, latency and last look introduce additional risk component. The liquidity consumer is faced with a probabilistic framework to drive not only passive but also aggressive order allocation optimisation. The optimisation procedure needs to leverage the machine learning capabilities to deal with ever changing market conditions, take into account the specifics and geographical location of different liquidity pools as well as the impact of allocation strategy on the forthcoming order flow.

The sophistication of trading strategies is by no means the only component of successful algorithmic execution. While the algorithms do optimize order placement given the liquidity pool, it is also extremely important to optimise the liquidity pool itself (liquidity curation).

Liquidity consumers need to embrace a two-way dialogue with their liquidity providers (LPs) as an integral part of their liquidity curation process. Ideally, each liquidity consumer should build their own profile by deploying quantitative techniques. This can be done by recording key metrics:

• Fill Rates: Key statistically derived parameters looking at the percentage of orders that have been filled, based on the total number submitted. The higher the fill rates, the lower the likelihood of a child order not being executed, which becomes of increasing importance in a volatile market and minimises information leakage.

• Round Trip Times: The time it takes to execute the order from submission to fill confirmation. Last look, geographical delocalisation of FX markets and fragmentation can cause latency, increasing the time taken to fill the child order.

• Market Impact: the change in market price due to the execution of the specific child order, which is inherently related to fill rates and round trip times.

The accuracy of these statistics is vastly dependent on the volume of the data aggregated as the more information available, the better the impact on the overall execution results. Once all the data has been collated and analysed, many discussions take place with the various liquidity providers to customise their pools of liquidity. This becomes all the more important given the fragmented liquidity displayed within the FX environment, combined with the spectrum of liquidity types, especially over periods of market stress. Liquidity curation is an iterative process which is constantly managed to ensure that the resulting execution outcome is optimal, both for the liquidity consumer and the liquidity provider.

Another critical component of curation is the diversification of liquidity. To minimise price slippage, an algorithmic strategy needs unique and uncorrelated – or ‘orthogonal’ – liquidity. When liquidity is not curated for orthogonality, end-users may be exposed to wider aggregated spreads, higher market impact, increased liquidity mirage and low fill rates. The enhancement of a liquidity pool has become increasingly important as the FX markets continue to turn more electronic not just in spot but moving to the Non Deliverable Forwards (“NDF”), too. Over a year ago, the NDF market consisted of a single venue providing firm prices both on and off swap execution facilities. Liquidity was easy to navigate, with credit being the sole differentiation between dealers. There is an increasing number of external pools of liquidity offering a combination of both firm and last look prices, however the market is still maturing and there is a need to leverage on the internal bank franchise for additional liquidity. The framework of the execution strategies used for the deliverable spot market has been calibrated to adapt to the NDF liquidity conditions, which tend to be volatile and sensitive to sided flow.

March 2020 saw an unprecedented rise in market volatility and widening of spreads due to the impact of Covid-19. Wider spreads and diminished liquidity created particular challenges for larger transactions. Taking all of these factors into consideration, clients turned to algorithms to help navigate their way through an increasingly fragmented FX market, opting for smarter execution.

A use case that emerged during this period was for clients to start out with a passive strategy, testing liquidity and observing any impact, with the ambition of capturing spread. However, if volatility significantly increased, then they could resort to a strategy that cleared the risk more aggressively; HSBC’s Liquidity Plus product facilitates the flexibility to switch between strategies either manually or on the basis of a defined market level.

During this period of time, both volatility and spreads increased. It is interesting to note is that, at least for some instruments, long-term volatility increase was relatively less pronounced than that of short-term, or high-frequency volatility. This effect could also explain the significant increase in algorithms usage as the risk of waiting was overshadowed by the cost of crossing.

As the electronification continues to develop across various FX products, such as NDFs, the synergies between the deliverable spot algorithmic execution and risk management can be easily translated. The liquidity curation combined with sophisticated analytics and adaptive algorithm behaviour are prerequisites to navigating the complexities observed in FX markets. Consequently, clients will need an FX partner with a deep understanding of market micro-structure, access to a quality liquidity pool and technical ability to operate in geographically delocalized environment.